working capital funding gap in days

Companies with high volatility. The pandemic crisis posed unique challenges in the ability to procure funding resulting in a.

Since cost of sales was 718 it had to finance 6318000 for each day of its cash gap.

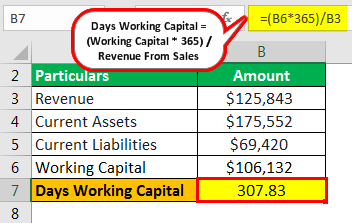

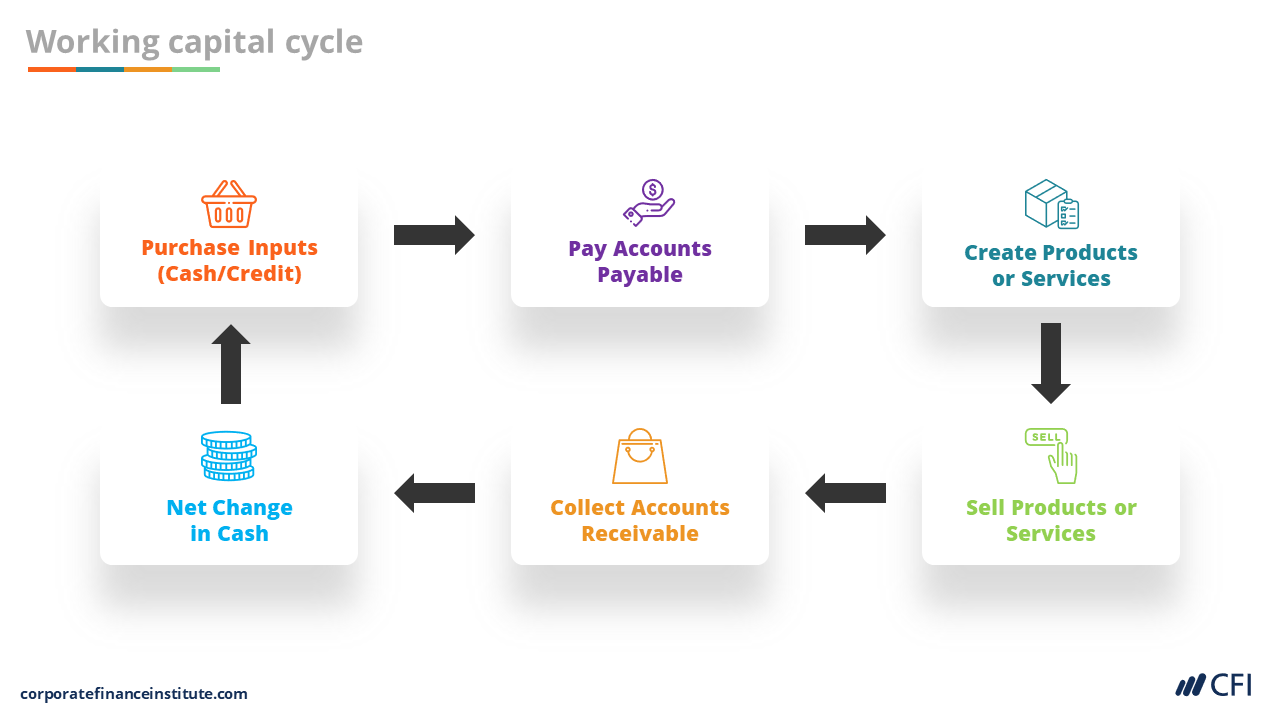

. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank. Calculation of Days Working Capital. The day-to-day operations can be.

Here in the above example as we can see the Days working Capital is 126 days and that denotes the company. Working Capital Gap. According to a recent working capital practices study of the manufacturing and distribution industry 161 percent of accounts receivable are still in the bush 180 days after.

90 days 90 20k invested x 90 18k 38k paid back. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently provided by. Working Capital Days Receivable Days Inventory Days Payable Days.

365 413 361 583 329 Based on the information below how much does the company need to finance. Days in the period. 456 Days in the period.

Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Our 5 Step Process. It is a measure.

40k invested x 90 36k 76k paid back. We can help you with your down payment or Gap Funding for personalinvestment properties. Working capital Working capital is required to.

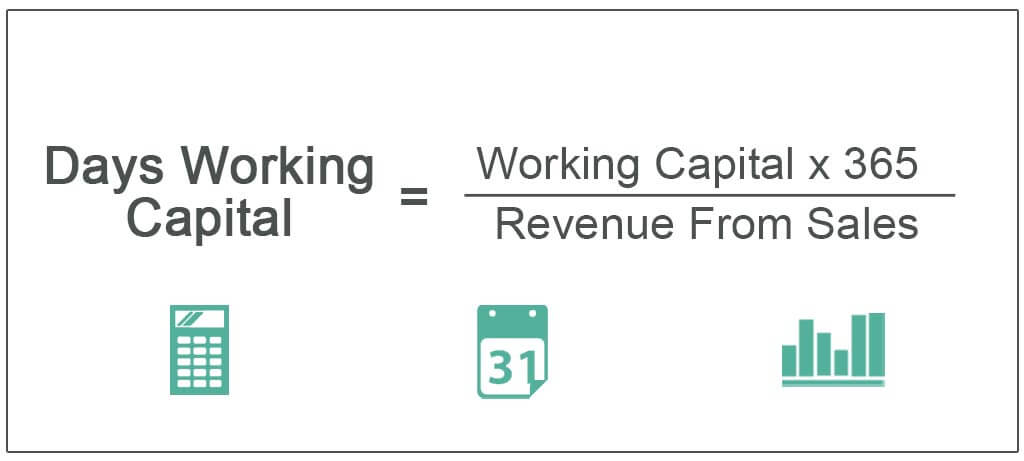

Days working capital 73 days. The days working capital is calculated by 200000 or working capital x 365 10000000. Whats the companys working capital funding gap in days based on the information below.

It can also be described. In plain terms the working capital deficit is the difference between total liquid assets and total equity other than bank liabilities. However if the company made 12 million in.

90k invested x 90 81k 171k paid back. If however the business chooses to use long term finance this flexibility is. Fund your next fix flip.

Even if the terms are. For instance if your supplier terms are 30 days and your customer terms are 60 days you will have a cash flow gap to fill with some form of working capital financing. Get the cash you need in as little as 5 to 7 days.

Operate the business serve the customers deal with some variation in the timing of cash flows Working capital is a basic measure of. Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625. By substituting 90 days instead of 45 days in the formula used above the working capital requirement doubles to 45000 or 247 of revenue.

Working Capital Funding Gap WCFG When we brainstorm on the reason for working capital funding gap most of the factors affecting such gap revolves around current. Working capital metrics in comparison to other industries. If the poor collection procedures.

Why you should use us for First. This ratio measures how efficiently a company is able to convert its working capital into revenue. However a capital-intensive company will have a different ratio and in the case of negative working capital the ratio might reverse in most cases.

If the company borrowed money at 7 it paid 442288 in interest for each day in its cash gap. 345 Payable days. 472 Inventory days.

Days Working Capital Definition Formula How To Calculate

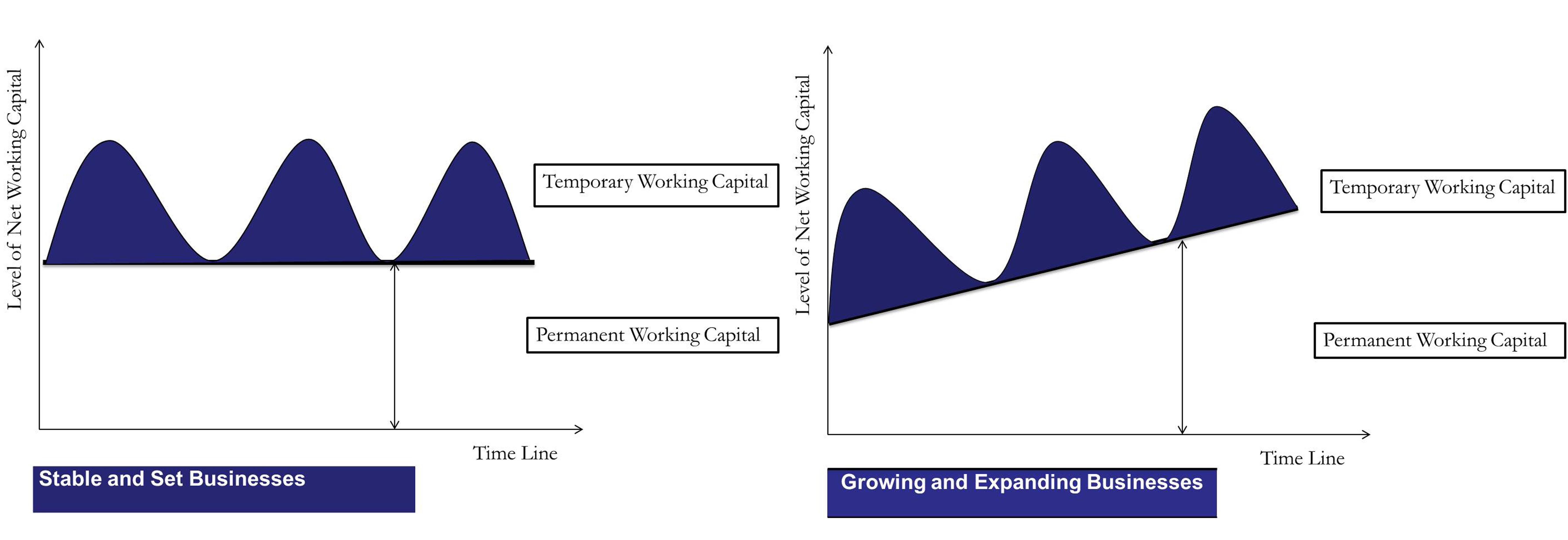

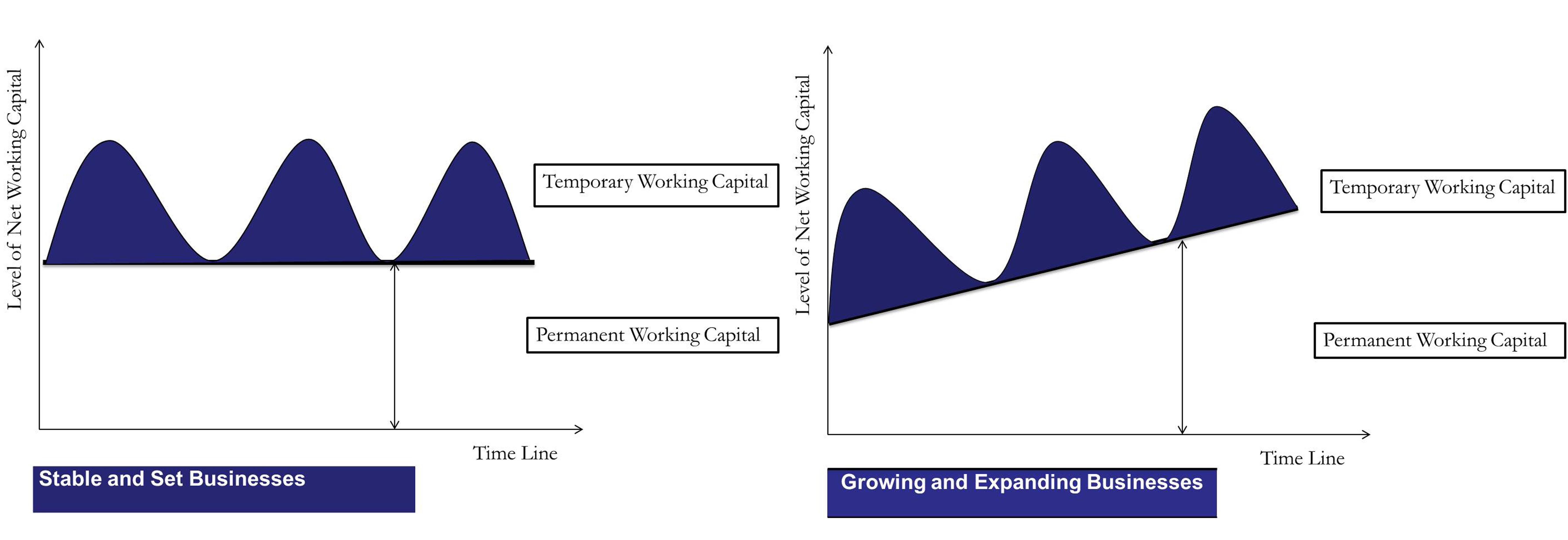

Types Of Working Capital Gross Net Temporary Permanent Efm

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Cycle What Is It With Calculation

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Cycle Definition How To Calculate

Temporary Or Variable Working Capital

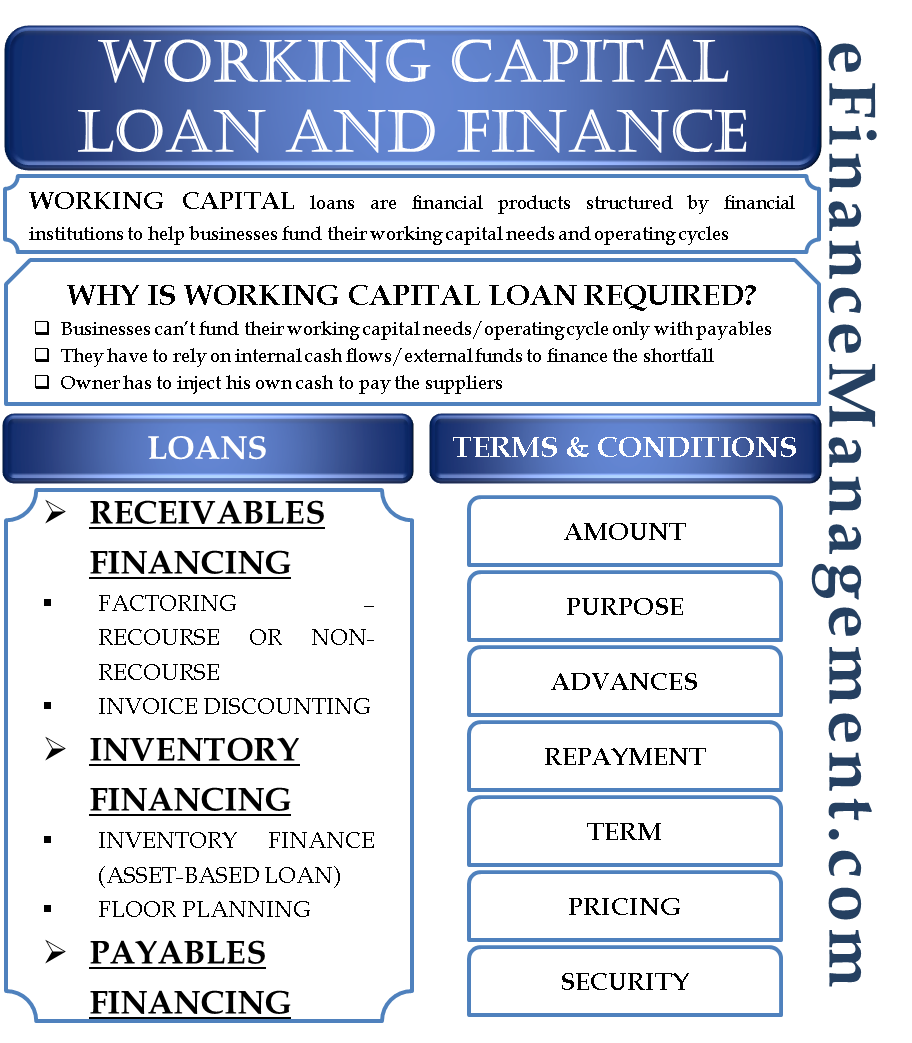

Working Capital Loan Finance Types Terms Conditions Requirement

Days Working Capital Definition Formula How To Calculate

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital Formula Youtube

Cash Conversion Cycle Formula And Excel Calculator

Cash Flow Cycles And Analysis Cfi

Methods For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Company Fundamentals When Negative Working Capital Is Not A Bad Thing The Financial Express

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Cycle Understanding The Working Capital Cycle

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)